Discounts on Auto Insurance Policies

Many of these rebates are awarded for features that are now considered to be prerequisites for purchasing a new vehicle, such as daytime running lights, airbags, and anti-lock brakes.

Bundle and Save

When you combine your GEICO auto insurance policy with your GEICO homeowners insurance policy, you might end up saving money.

Additional Ways to Cut Costs on Your Auto Insurance

If you are a student, an employee of the federal government, or a member of the military forces, GEICO may be able to offer you a discount on your auto insurance.

Why do you feel the need to get auto insurance?

You are required to get auto insurance if you own a car. In the event that you are involved in an accident, having auto insurance may assist offer financial security for you and perhaps other people as well. It won’t take you more than a few minutes to acquire a quotation for customised auto insurance that includes the most competitive premiums, discounts, and choices that are accessible to you.

Why should you get your motorbike insurance with GEICO?

You won’t have to make sacrifices in coverage to take advantage of our competitive rates.

Protection for the customizations you’ve made to your vehicle, sometimes known as accessories coverage.

A skilled group of qualified motorcycle agents that share your passion for the sport and are versed in all aspects of it.

What kinds of motor vehicles are included in the coverage?

GEICO provides coverage for a wide range of automobiles in addition to motorcycles. Insurance for motorcycles can be purchased for:

Cruisers are a category of motorcycles that most commonly have a V-twin powerplant with an exposed engine. Sport bikes, often known as street bikes, are high-performance motorbikes that are recognised for their speed. Touring bikes are motorcycles that are designed to make riding for extended periods of time more pleasant. Custom motorcycles are those that have been manufactured to the owner’s specifications by either the manufacturer or a local shop. Mopeds are bicycles that are both lightweight and driven by a tiny motor.

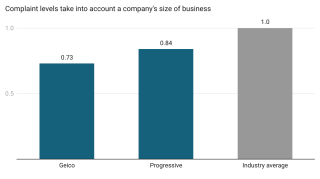

If you are looking for affordable vehicle insurance, it is in your best interest to investigate Geico because the company offers car insurance rates that are quite reasonable across a wide range of driver profiles. You could qualify for one of the various auto insurance discounts that Geico offers, which would bring your cost down even more.

Pros

Great auto insurance rates for safe drivers as well as people who have been pulled over for speeding, have a history of bad credit or have been discovered driving without insurance. Also provides excellent prices for older citizens and young drivers, both of which may be highly costly to insure.

Provides forgiveness in the event of an accident. Provides a usage-based insurance programme known as DriveEasy for safe drivers who are interested in attempting to lower the cost of their vehicle insurance based on how they typically drive. When compared to the national average of $3,074 per year, the auto insurance rates offered by Geico are often favourable for drivers who have been responsible for an accident that resulted in harm to another person.

Because there is such a large range of prices offered by different providers of auto insurance, it is in your best interest to shop around after being at fault for an accident. Geico offers vehicle insurance prices for drivers with a DUI that is comparable to those of other insurance providers. Geico’s average pricing for drivers with a DUI is less than the national average cost of vehicle insurance for drivers with a DUI, which is $3,537 per year on average.