In addition to giving customers freedom and affordable coverage, Geico has also been successful because of its emphasis on cost-cutting in its marketing. Geico’s creative and user-friendly efforts are major contributors to the company’s success. Light and humorous, Geico ads set themselves out from the competition and help the company capture a sizable percentage of the U.S. insurance market. Government Employees Insurance Business (/ako/) is a private American vehicle insurance company based in Chevy Chase, Maryland. After State Farm, it is the largest car insurance in the country. More than 24 million automobiles, belonging to more than 15 million policyholders, are insured by GEICO, a completely owned subsidiary of Berkshire Hathaway.

GEICO provides vehicle insurance to private motorists in every one of the 50 states plus DC. Local agents (called GEICO Field Representatives) represent the company in person, while licenced insurance agents handle phone and online sales. To represent the company, English actor Jake Wood lends his voice to a gold dust day gecko with a Cockney accent. GEICO has developed countless comedic ads throughout the years, contributing to the company’s widespread notoriety in popular culture. If you don’t know GEICO from the gecko, you probably know it from the caveman. Company policyholders in the United States number in the millions, and the Maryland-based company insures more than 28 million automobiles. In terms of insurance, it’s a formidable opponent.

What kinds of products does GEICO insure?

GEICO’s most well-liked product is insurance for private automobiles. Motorcycle, ATV, RV, and boat insurance, as well as homeowner’s, renter’s, condo, co-op, and mobile home insurance, personal umbrella protection, life insurance, flood insurance, overseas insurance, business owner’s, professional liability, general liability, commercial auto, collector car, identity theft protection, and jewellery insurance are all available through GEICO in addition to private passenger auto insurance. In 1936, at the height of the Great Depression, GEICO was created by Leo and Lillian Goodwin, a husband-and-wife duo who had the foresight to start a business.

Named for its intended clientele, federal workers and certain ranks of enlisted military officers were the company’s first customers when it opened its doors in 1921 as the Government Employees Insurance Company. As of December 31, 2012, GEICO has employed 12 people and issued 3,700 policies. Benjamin Graham, a management professor at New York’s Columbia University, made a GEICO investment in 1948. For the company, this was a watershed event since Graham would go on to educate a young Warren Buffet at Columbia, forever linking the two titans of business. In 1951, Buffet took a trip to Washington, DC, to learn more about GEICO, and while there he met with Lorimer Davidson, a mutual acquaintance of the Goodwins and an investment banker.

The encounter convinced Buffet to invest in GEICO shares, and the rest, as they say, is history. In 1958, Goodwin retired, and Davidson took over for him. He went on to steer the firm for the next two decades, during which time it added a million policyholders and generated $150 million in insurance premiums by 1965. The company’s loss reserves began to show the effects of years of aggressive development when growth halted in the 1970s. In response, GEICO implemented stringent underwriting practises, which is widely believed to have been the impetus for Warren Buffet’s second public appearance in 1976 when he allegedly invested $1 million in GEICO stock. In the 1980s, GEICO began offering customer care by phone around the clock, every day of the year. The company still operates with the same model that places the consumer at the centre.

Feedback from Happy Clients

GEICO, the second biggest vehicle insurance company in the world, is owned by Berkshire Hathaway. According to the National Association of Insurance Commissioners, it will hold a 13.6 percent share of the market in 2020. (NAIC). According to a recent customer satisfaction assessment conducted by J.D. Power, GEICO is among the best big car insurers in the US because of its competitive rates, wide selection of coverage options, simple application process, and user-friendly website. During the H1N1 pandemic, J.D. Power found that pricing was still more important than the overall shopping experience.

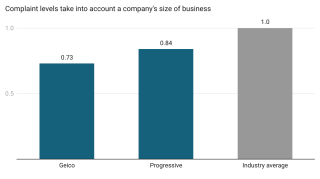

Although GEICO did well in this category, its performance in the claims satisfaction category was below par. Numerous review and comparison sites gave GEICO an average rating of between 4.0 and 4.5 stars. As an example, a Forbes adviser rated it four stars, praising its low incidence of insurance complaints and excellent rates for drivers with weak credit. Collision repair shops generally have low opinions of GEICO’s products, and the company’s premiums for drivers with a DUI conviction are significantly higher than those of its competitors.