Divorce and Retirement: Planning for Your Future in 2024

Introduction

As we step into 2024, life’s twists and turns may lead some couples to contemplate divorce. Divorce is a life-altering event, and when it intersects with retirement, the impact can be significant. In this article, we will explore the connection between divorce and retirement, the financial implications, and strategies for safeguarding your future.

Divorce and Retirement: A Sensitive Connection

Divorce and retirement are intertwined in more ways than one might realize. The decisions made during a divorce can have a long-lasting effect on your retirement savings and plans. It’s essential to approach this sensitive connection with caution and foresight.

Understanding the Impact of Divorce on Retirement

Divorce can affect your retirement in several ways. It may lead to the division of retirement assets, changes in your income, and adjustments to your retirement goals. Understanding these impacts is crucial for effective planning.

Dividing Retirement Accounts in Divorce

One of the most complex aspects of divorce and retirement is dividing retirement accounts. We’ll delve into the legal and financial intricacies of splitting 401(k)s, IRAs, and pensions, ensuring a fair distribution.

Strategies to Safeguard Your Retirement Post-Divorce

Protecting your retirement post-divorce requires careful planning. We’ll discuss strategies to minimize the financial impact, such as creating a post-divorce budget and revising your retirement plan.Divorce and Retirement: Planning for Your Future in 2024

The Importance of Financial Planning

Financial planning plays a vital role in securing your retirement after divorce. We’ll explore the significance of working with financial professionals to make informed decisions.Divorce and Retirement: Planning for Your Future in 2024

Rebuilding Your Retirement Savings

If your retirement savings take a hit during divorce, don’t lose hope. We’ll provide insights into rebuilding your savings, including smart investment strategies and contributing to retirement accounts.Divorce and Retirement: Planning for Your Future in 2024

Seeking Professional Guidance

Navigating the complexities of divorce and retirement can be overwhelming. Seeking professional guidance from financial advisors and attorneys can help you make the right decisions.Divorce and Retirement: Planning for Your Future in 2024

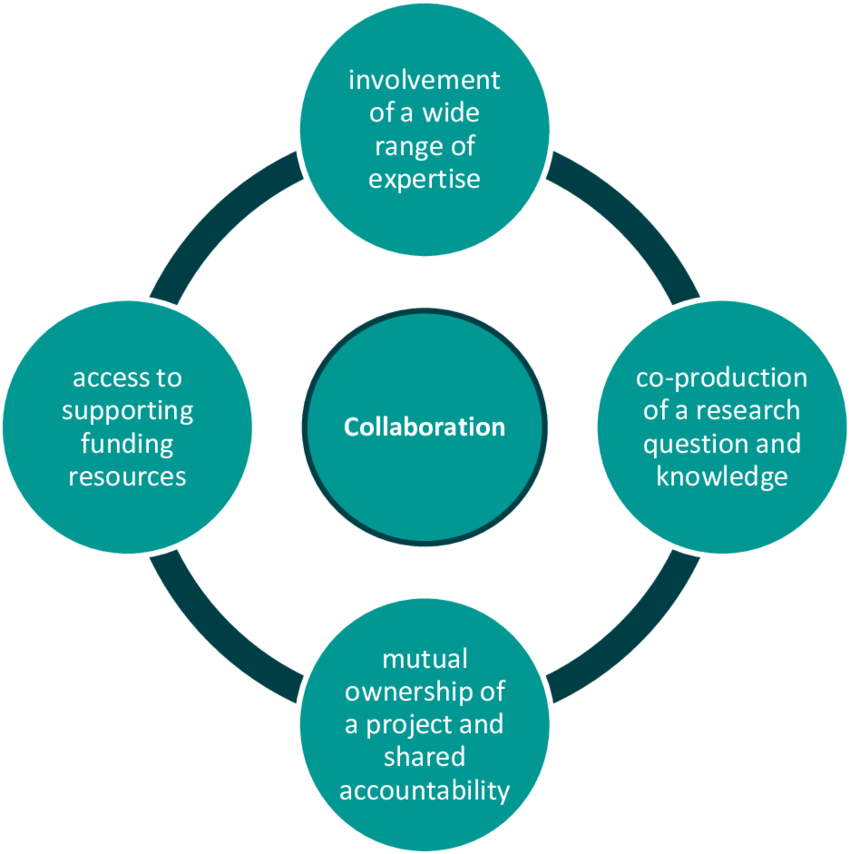

The Benefits of Collaborative Divorce with an Attorney in 2024

Emotional Resilience and Retirement

The emotional toll of divorce can affect your outlook on retirement. Learn how to build emotional resilience and maintain a positive attitude about your future.Divorce and Retirement: Planning for Your Future in 2024

Creating a Retirement Vision

Despite the challenges, it’s essential to maintain a vision for your retirement. We’ll discuss setting new retirement goals and adjusting your plans to align with your post-divorce life.Divorce and Retirement: Planning for Your Future in 2024

Conclusion (Divorce and Retirement: Planning for Your Future in 2024)

In conclusion, divorce and retirement are interconnected, and the decisions you make during divorce can significantly impact your retirement. By understanding these connections, seeking professional guidance, and staying emotionally resilient, you can create a brighter retirement future in 2024.Divorce and Retirement: Planning for Your Future in 2024

FAQs on Divorce and Retirement (Divorce and Retirement: Planning for Your Future in 2024)

1. Can my ex-spouse claim a share of my retirement savings during divorce?

The division of retirement accounts in divorce depends on various factors, including state laws and the terms of your divorce agreement. It’s crucial to consult with a legal expert for specific guidance.Divorce and Retirement: Planning for Your Future in 2024

2. How can I protect my retirement assets in case of divorce?

Protecting your retirement assets may involve a prenuptial agreement or careful planning during divorce. Working with a financial advisor and attorney is recommended.Divorce and Retirement: Planning for Your Future in 2024

3. What happens to Social Security benefits after a divorce?

In some cases, you may be entitled to claim Social Security benefits based on your ex-spouse’s record. Understanding the eligibility criteria is essential.Divorce and Retirement: Planning for Your Future in 2024

4. How can I rebuild my retirement savings after a divorce?

Rebuilding your retirement savings may involve increasing contributions to retirement accounts, revising your investment strategy, and seeking expert financial advice.Divorce and Retirement: Planning for Your Future in 2024

5. Is it possible to retire early after a divorce?

Retiring early after a divorce is possible but may require a more aggressive savings and investment approach. Consulting a financial planner is advisable to assess your specific situation.Divorce and Retirement: Planning for Your Future in 2024

In this article, we’ve explored the intricate relationship between divorce and retirement, offering insights into the financial and emotional aspects. By planning wisely and seeking professional advice, you can ensure a secure retirement in 2024 and beyond.Divorce and Retirement: Planning for Your Future in 2024