2024 Student Loans: What You Need to Know

Student loans have become an integral part of many individuals’ lives as they pursue higher education. With the ever-evolving landscape of student loans, it’s crucial to stay informed about the latest developments and changes, especially in the year 2024. In this article, we will delve into the state of student loans in 2024, covering federal and private loan options, forgiveness programs, repayment strategies, and much more. Whether you’re a current student or a recent graduate, understanding the ins and outs of student loans is essential for your financial well-being.

The State of Student Loans in 2024

The year 2024 marks a pivotal moment in the realm of student loans. With the rising cost of education, it’s no surprise that an increasing number of students are seeking financial assistance to fund their studies. This year, student loan debt is expected to reach unprecedented levels, making it a hot topic among policymakers, economists, and students alike.2024 Student Loans: What You Need to Know

Federal Student Loans

Types of Federal Loans

Federal student loans are a common choice for many students due to their competitive interest rates and borrower protections. In 2024, there are several types of federal loans available, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Each of these loans serves a different purpose, catering to the specific financial needs of students.2024 Student Loans: What You Need to Know

Interest Rates and Repayment Options

Understanding the interest rates and repayment options for federal loans is crucial. In 2024, the interest rates for federal student loans are expected to remain low, offering students a cost-effective way to finance their education. Additionally, repayment options like Income-Driven Repayment Plans will provide flexibility for borrowers in managing their loan payments.2024 Student Loans: What You Need to Know

Private Student Loans

While federal loans are widely accessible, some students may turn to private loans to bridge the financial gap. Private student loans are offered by banks and other financial institutions, and they come with their own set of advantages and disadvantages. It’s important for students to weigh the pros and cons carefully before opting for private loans in 2024.2024 Student Loans: What You Need to Know

Loan Forgiveness Programs

Public Service Loan Forgiveness

One of the most sought-after programs for borrowers with federal loans is the Public Service Loan Forgiveness program. This program is designed to forgive the remaining balance on your Direct Loans after you have made 120 qualifying payments while working full-time for a qualifying employer. As of 2024, this program remains a viable option for those pursuing careers in public service.2024 Student Loans: What You Need to Know

Income-Driven Repayment Plans

Income-Driven Repayment Plans are an excellent solution for graduates with federal student loans. These plans calculate your monthly payment based on your income and family size, ensuring that your loan payments remain affordable. In 2024, these plans will continue to provide financial relief for those with variable income.2024 Student Loans: What You Need to Know

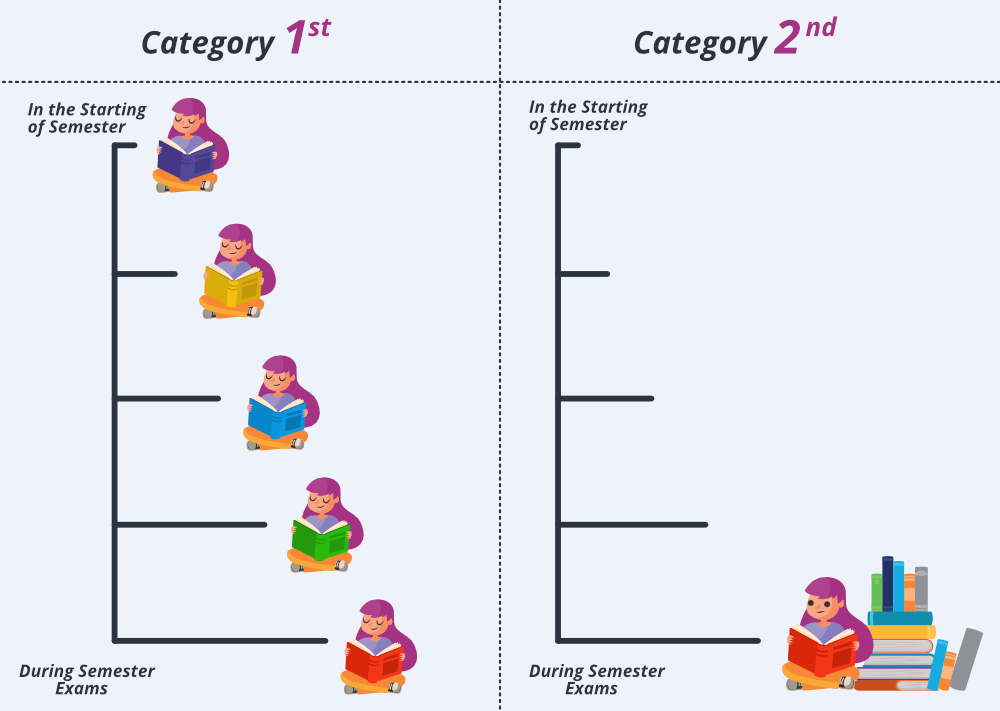

Planning for Student Loan Repayment

As you approach your graduation date, it’s essential to start planning for your student loan repayment. Consider creating a budget that accounts for your monthly loan payments, and explore the various strategies available to pay off your loans efficiently.2024 Student Loans: What You Need to Know

Tips for Managing Student Loans

Managing student loans can be challenging, but with the right approach, it’s manageable. In 2024, we’ll share valuable tips on managing your loans, from staying organized to taking advantage of loan servicer resources.2024 Student Loans: What You Need to Know

The Impact of Student Loans on Your Financial Future

Your student loans have a significant impact on your financial future. Understanding how they affect your credit score, debt-to-income ratio, and overall financial health is crucial. In 2024, we’ll explore these ramifications in detail.2024 Student Loans: What You Need to Know

2024 Student Loan Trends

The landscape of student loans is constantly changing. We’ll discuss the trends that are expected to shape the student loan industry in 2024, providing insights into what borrowers can expect in the coming years.2024 Student Loans: What You Need to Know

Legislative Changes Affecting Student Loans

With the continuous debate on student loan reform, 2024 may see significant legislative changes that could impact borrowers. We’ll keep you updated on any legislative developments that could affect your student loans.2024 Student Loans: What You Need to Know

Conclusion (2024 Student Loans: What You Need to Know)

In conclusion, navigating the world of student loans in 2024 requires a thorough understanding of your options and responsibilities as a borrower. Whether you have federal or private loans, being informed about the latest developments and repayment strategies is essential for financial success.2024 Student Loans: What You Need to Know

Frequently Asked Questions (FAQs) (2024 Student Loans: What You Need to Know)

1. How do I apply for federal student loans in 2024?

- Applying for federal student loans in 2024 is a straightforward process. You’ll need to complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility and receive financial aid.2024 Student Loans: What You Need to Know

2. Are interest rates for federal student loans fixed or variable in 2024?

- As of 2024, interest rates for federal student loans are fixed, ensuring that your interest rate remains the same throughout the life of the loan.2024 Student Loans: What You Need to Know

3. Can I refinance my student loans in 2024?

- Refinancing federal loans in 2024 may not be advisable, as you could lose valuable borrower protections. However, you can explore refinancing options for private loans to potentially lower your interest rates.2024 Student Loans: What You Need to Know

4. What are the eligibility requirements for the Public Service Loan Forgiveness program in 2024?

- To be eligible for the Public Service Loan Forgiveness program in 2024, you must work full-time for a qualifying employer and make 120 qualifying payments while enrolled in an eligible repayment plan.2024 Student Loans: What You Need to Know

5. How can I stay updated on legislative changes regarding student loans in 2024?

- To stay informed about legislative changes affecting student loans in 2024, regularly check official government websites, and consider subscribing to news sources specializing in education and finance.2024 Student Loans: What You Need to Know

In this constantly changing landscape of student loans, staying informed and making well-informed decisions is essential. By following the guidelines and strategies discussed in this article, you can take control of your student loans and set yourself on the path to a financially secure future.2024 Student Loans: What You Need to Know