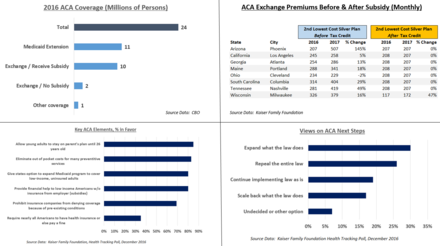

Health care subsidies are available to individuals, families, and small companies with moderate incomes thanks to the Affordable Care Act, also known as Obamacare. Additionally, it widens access to free Medicaid for low-income families. Companies and households with greater incomes that do not offer their employees health insurance are penalised. Obamacare premiums vary by age, income, family size, location, and the specific plan selected. The cost of insurance can vary widely from state to state. The cost of an insurance policy for a family is higher than that for an individual or a couple. The Silver plan, if one is available in your region, serves as a standard. A portion of the cost of this plan is covered by a government subsidy. Obamacare premiums are often higher for younger and healthier enrollees. There is a discount for the elderly and the sick.

In 2022, an individual has to make at least $12,880 per year to get by. Premium Tax Credits will be withheld from any single individual whose reported income is below this threshold. If you want to choose the best health insurance category for you, you need to first assess your overall health care expenditures and then choose the plan that reduces those costs by the most. You’ll have different expenses at different ages. Insurance firms can charge older individuals more, but not more than three times what they charge younger customers for the same coverage. The third factor is your physical location. Some cities have a greater general cost of living, while others have lower costs of living, including those for medical care.

Your family’s income and the number of people in it come in at #4 and #5. Tax credits or other forms of financial aid may be available to help you pay for insurance if you meet certain criteria. The ratio of your family’s income to the Federal Poverty Level is a common indicator of this.

Expenses You Can Expect From Obamacare

Health care under the Affordable Care Act may be more or less expensive, depending on your income, family size, and employer.

Exactly what factors into the cost of Obamacare?

You should expect to pay more or less for a plan on the Marketplace depending on the type of plan you select and general healthcare inflation rates. Subsidized health insurance premiums are available to individuals who qualify based on their household’s income and the number of people in their family as well as the availability of group health insurance via their place of employment.

If I have no means of support, why should I be expected to pay the whole cost of Obamacare?

Even if you don’t have a job of your own, your spouse’s salary might make it such that you don’t qualify for subsidies. Eligibility for subsidies may also be revoked if the applicant is not a U.S. citizen or permanent resident.

How Do I Calculate My Obamacare Subsidy for 2023?

Subsidies, also known as premium tax credits, are calculated using three variables: your income, the price of the benchmark plan, and the minimum contribution you’ll have to make under the Affordable Care Act. If your estimated contribution is lower than the benchmark plan’s, you will get a subsidy. Because most people enrol for health insurance in the months leading up to the new calendar year, you’ll need to make a conservative prediction about your income. Prior to starting coverage, it is important to evaluate the overall plan premium in light of your family’s income.